Technical upgrade.

Some regulatory changes

Some legal adjustments

Some legal changes

Some legal changes

The latest version only contains bug fixing.

The latest version only contains bug fixing.

The latest version only contains bug fixing.

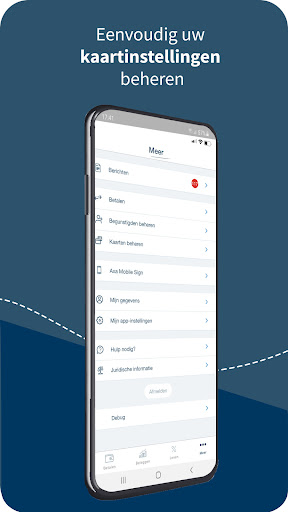

- Would you like to schedule an appointment with your AXA Bank Agent at a time of your choosing? You can now do this via “More” > “Need help?” > “Your AXA bank agents” and other places in the app where you see the button or link “Make an appointment”.

- You can now adjust your preference for whether or not so-called trackers are allowed via the menu “More” > “My app settings” > “Trackers and permissions”.

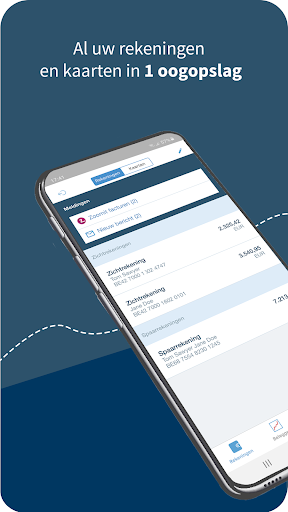

The app has been given a thorough makeover: maximum ease of use and significant time savings when using:

- new, more intuitive layout for all screens

- action buttons at the top to easily and quickly find the most common actions such as payments, messages and documents

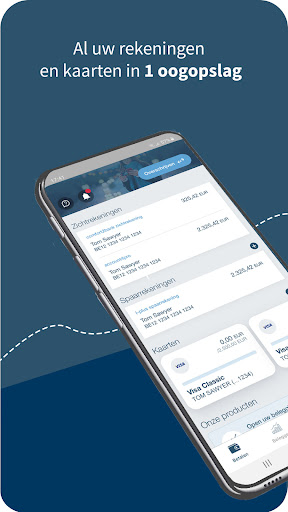

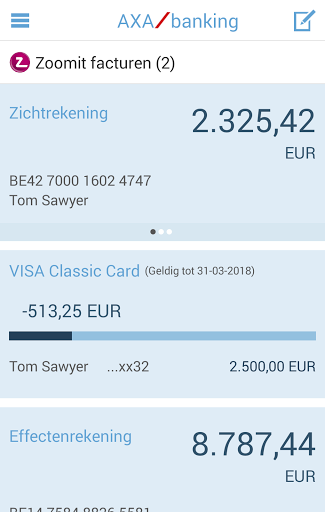

- direct access to all your accounts and your cards from the start screen

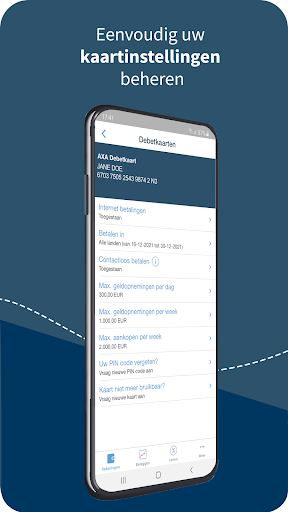

- change the settings of your cards in 1 click (limits, request a new pin or card,…)

- a clearer menu

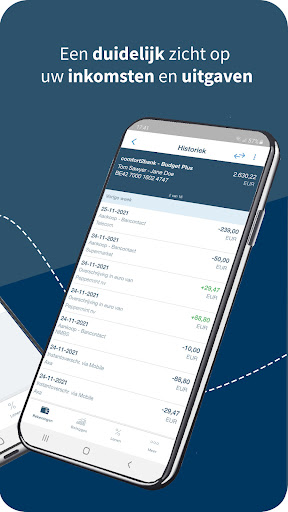

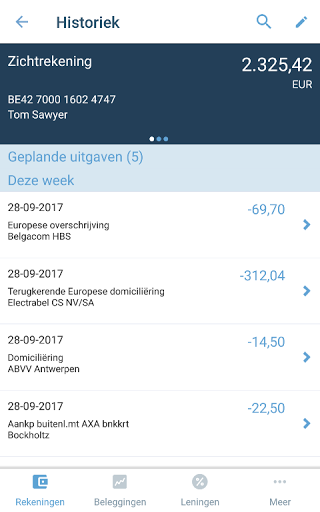

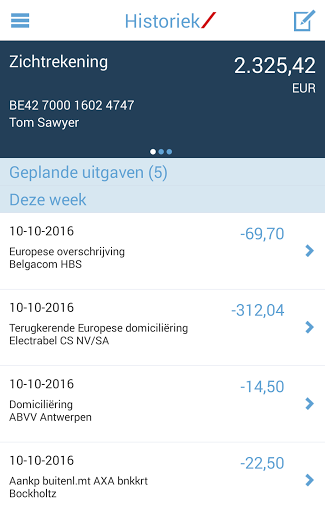

- Payments received are now shown in green in your account history so that you can more easily distinguish between income and expenses.

- Did you miss the content of a notification or do you want to read it again quietly? This is now possible under the 'More' menu, section 'Push notifications'.

- A problem with your debit card that means it needs to be replaced? You can now request a new card in the app. Click on 'Maps' and then on the map in question for the settings

- Payments received are now shown in green in your account history so that you can more easily distinguish between income and expenses.

- Did you miss the content of a notification or do you want to read it again quietly? This is now possible under the 'More' menu, section 'Push notifications'.

- A problem with your debit card that means it needs to be replaced? You can now request a new card in the app. Click on 'Maps' and then on the map in question for the settings Do you

- From now on you can also fully manage your automatic payments and your beneficiaries.

- General improvements and bug fixes.

- If you want to manage your banking in the highest security and stability, make sure that

your device 's operating system is up-to-date: the app only supports Android OS version 5 or higher.

- From now on you can also fully manage your automatic payments and your beneficiaries.

- General improvements and bug fixes.

- If you want to manage your banking in the highest security and stability, make sure that

your device 's operating system is up-to-date: the app only supports Android OS version 5 or higher.

• You can now sign transactions with itsme®.

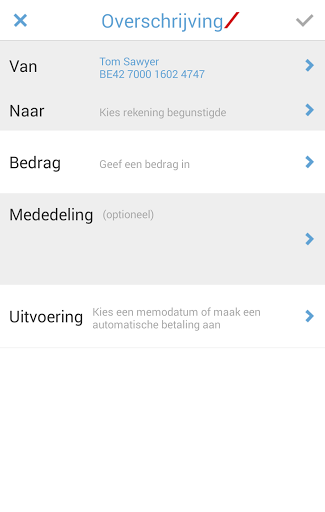

•Copying and pasting structured messages in a transfer is now possible

•Forgotten the PIN code of your debit card? You can request a new pin code via your card's Settings.

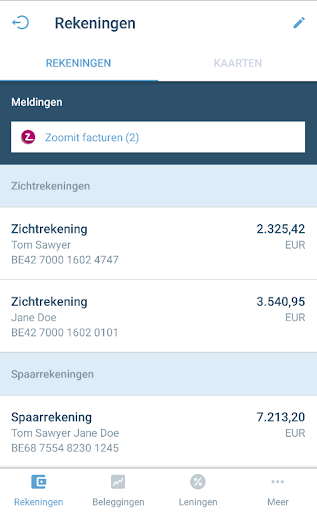

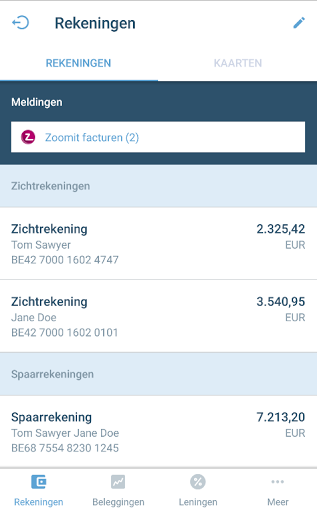

•From now on you will see both the current and the available balance on your account, eg in the case of transactions that have not yet been booked or if you have a credit line to go below zero.

•Bug fixing

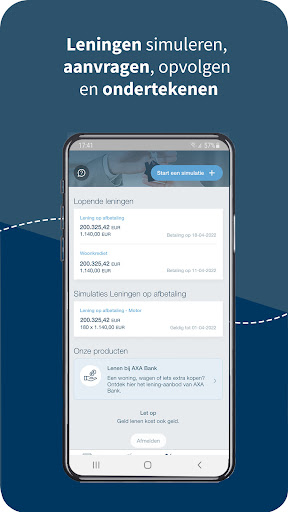

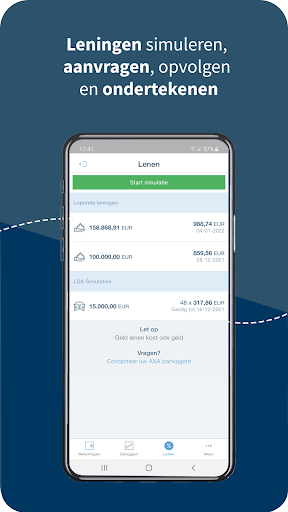

- You can now make a complete mortgage loan application based on a personalized simulation. You can also follow up and complete the credit applications submitted to your bank agent.

- General improvements and bug fixes

- If you want to manage your banking in the highest security and stability, make sure that your device's operating system is up-to-date: the app only supports Android OS version 5 or higher.

- You can now easily share your account number (s) with others

- General improvements and minor bug fixes

- If you want to manage your banking affairs in the highest security and stability, make sure that the operating system of your device is up-to-date: the app only supports Android OS version 5 or higher

- Now you can also run and save personalized mortgage loan simulations in the app, to discuss them later with your bank agent.

- General improvements and bug fixes

- If you want to manage your banking affairs in the highest security and stability, make sure that the operating system of your device is up-to-date: the app only supports Android version 5 or higher.

- Purchases made via your smartphone or tablet from a recognized supplier can now also be confirmed via the AXA mobile banking app.

- General improvements.

- If you want to manage your banking affairs in the highest security and stability, make sure that the operating system of your device is up-to-date: the app only supports Android version 5 or higher.

From now on, comfort2bank (premium) and account4pro customers can enter outgoing instant transfers in the mobile banking app.

-It is now possible to convert your start2bank current account into a comfort2bank current account when applying for a Visa credit card

-General improvements and minor bug fixes

-Android versions lower than version 5.0 are no longer supported

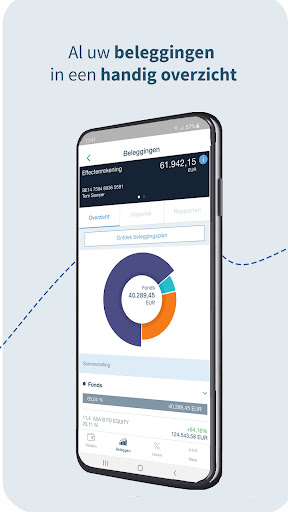

Be sure to send an email to onlineservice@nieuwsblad.be From now on you can follow the evolution of your Delegio Privilege fund and open / adjust an investment plan.

* It is now possible to request a conversion to a comfort2bank current account on the detail page of a start2bank current account.

* Some minor improvements

Be sure to send an e-mail to onlineservice@nieuwsblad.be From now on, in the mobile app you can:

* easily convert your start2bank current account into a comfort2bank current account

* follow up the status of your home loan application and upload the documents required to complete your application .

From now on you can consult and adjust your personal, legal and contact details.

Have fun with our app!

We have corrected a few minor bugs so that the app is usable for everyone.

* Users can digitally retrieve the storage statements of their credit card.

* Minor errors in adjusting the settings of your credit card have been eliminated.

Enjoy our app!

From now on you can:

* simulate and apply for a loan for an ecological car,

* receive important messages via push notifications (managed via settings in the “More” menu)

You can now:

-Use your fingerprint to log in or sign transactions.

-Easily open a pension savings account.

- read your messages and documents in the Inbox via the new “More” menu.

-Use your AXA Mobile Banking app to log in to Homebanking and sign transactions using AXA Mobile Sign.

Improved credit card flows

-A more user-friendly process to request credit cards. In the new process, a PIN code can be set by telephone. In addition, the card can be sent to a second known address.

-PIN changes and card replacements can now also be requested for all credit card types

More flexibility for your investment plan

-It is possible to make changes to an investment plan that is opened at an AXA bank branch

Adjustments for an even more user-friendly loan application

You can now also easily apply for an installment loan in mobile banking: a loan for a car, for renovations or renovations to your home or just for a little extra.

Have fun with our new app.

The statement statements of Visa Classic and Visa Premiumplus are digitally available through the AXA Banking app. Have fun with our new app!

Refreshment of the login screen.

Dear Customer,

In addition to minor improvements, this new version contains the adjustments in the context of the new privacy legislation (GDPR - General Data Protection Regulation).

With the new AXA bank cards (requested after 18/06/2018) you will be able to pay contactlessly. You can enable and disable this functionality yourself via the settings of the card.

Have fun with online banking.

Adjustments in the context of data privacy (GDPR)

What's new? - From now on you can choose from 6 funds to invest - From now on you can use a wizard to select the fund that suits you - Small adjustments and bug fixes Have fun with our new app

- You can now consult your current loans. - We also offer a new navigation so that you can consult your accounts and maps via a handy overview. Have fun with our new app!

When the internet connection is restored, the app will automatically use the new connection. The app does not need to be restarted.

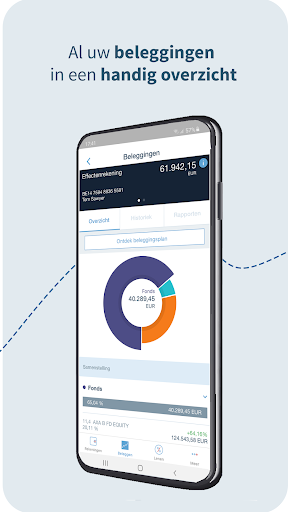

In mobile banking for smartphone you can now easily open an investment plan, adjust it and stop it if necessary. Thanks to the investment plan, you automatically invest a self-chosen amount at your own pace (for example, monthly), in your preferred funds.